WineDirect Products

The quick answer: It’s not just the weather. A decline in net club growth resulted in a slowdown in Wine Club results, and this is the real culprit.

For a more in-depth answer, let’s take a closer look at the first quarter DTC results to see what’s going on.

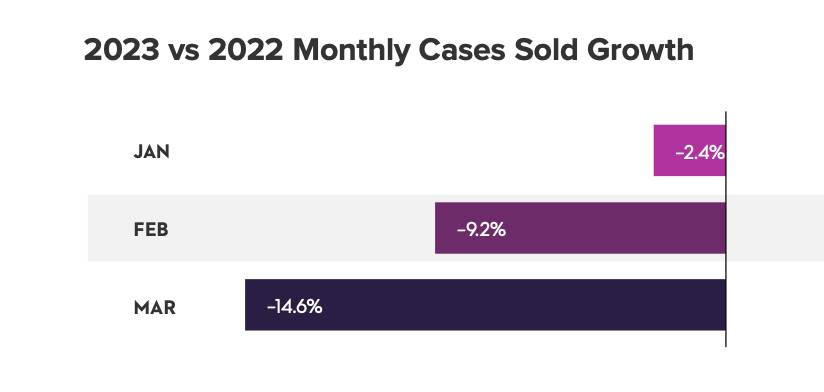

Along with our partner Enolytics, we’ve analyzed millions of anonymized DTC records, and the first quarter (Q1) of 2023 brought some interesting results. Winery DTC net sales were down -5.8% versus last year, and cases were down -10.1%. The declines versus a year ago worsened with each month in the quarter.

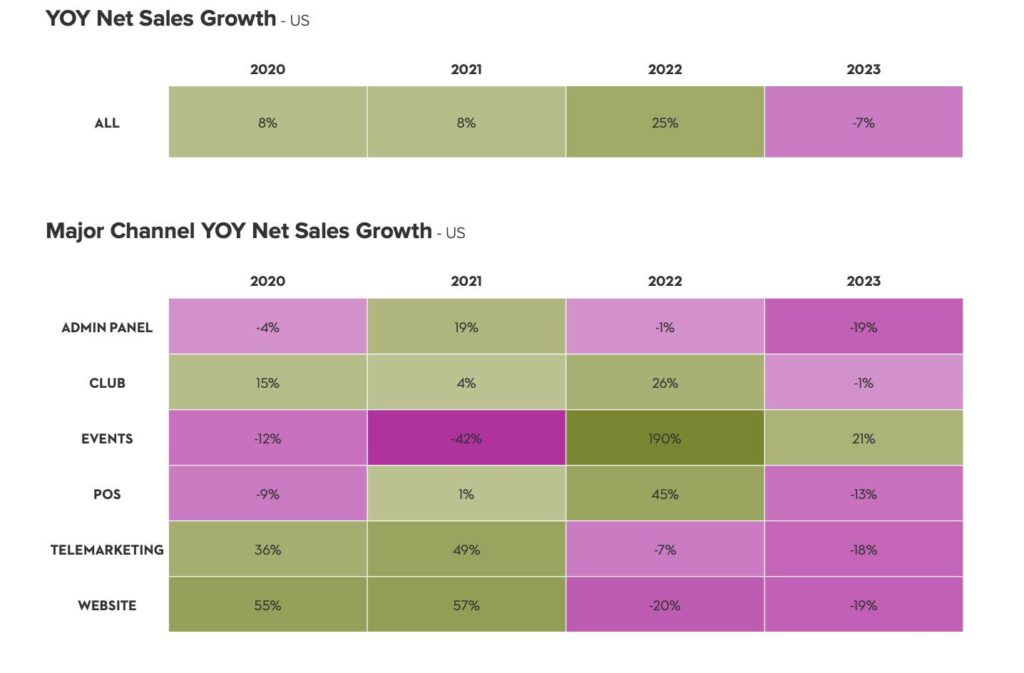

For the first time in over five years, all the main DTC channels – Wine Club, Point of Sale (POS) and Website - declined versus the same quarter a year ago in net sales and case sales. It is important to note that Q1 2022 was especially strong as sales through POS came roaring back after COVID closures, and winery price increases drove net sales to the highest we’d seen in at least five years. As a result, it’s not surprising that Q1 2023 was a bit of a letdown. Still, it’s disappointing to see these declines.

If we’ve learned anything over the past few years, it’s that the wine business is complex. Did cold and rainy weather in the Western U.S. during the first quarter dampen visitation? Likely yes, as we saw sales through POS down -13% versus last year. Again though, Q1 2022 was extremely strong, so we are measuring against a very high base.

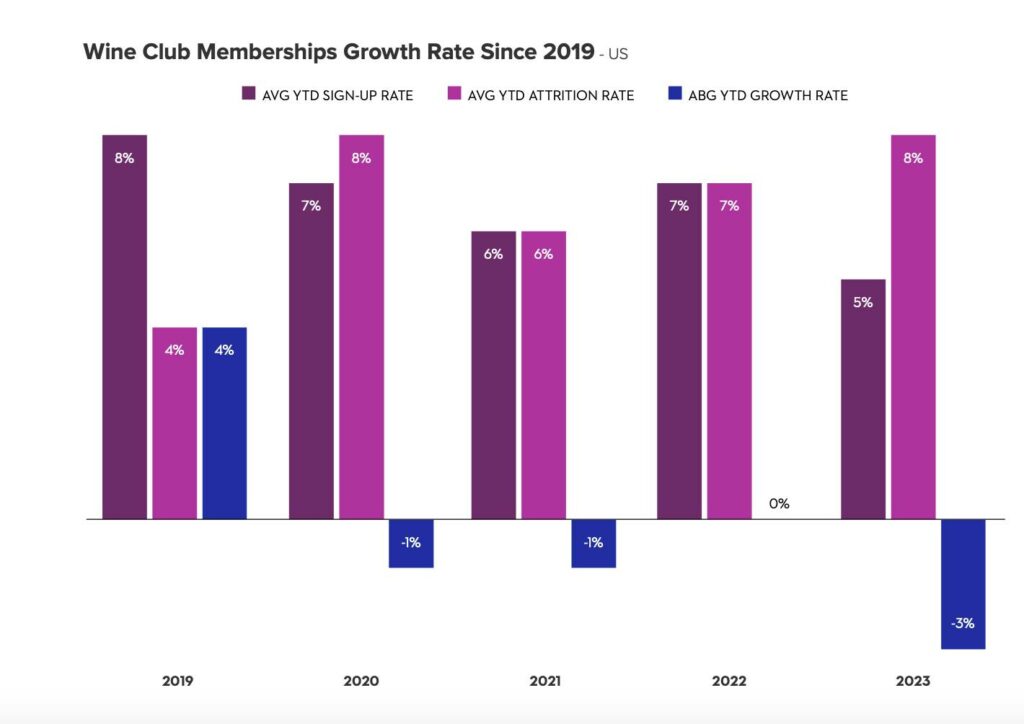

We’re seeing something else important happening, however. While both POS and Website channels showed large declines, the Wine Club channel declined for the first time in over five years. This is new, as over the past five years as Website and POS sales results have fluctuated, the Wine Club channel has been the star. In Q1 2023 however, it appears that several factors – poor weather, coupled with ongoing inflation and general economic uncertainty resulted in the lowest sign-up rate and the highest attrition we’ve seen in over five years. As the Wine Club channel generally represents more than half of winery DTC sales in the first quarter, this impacted overall industry results greatly.

We saw this coming. Remember those declining POS results we saw in the second and third quarters of 2022? The lower visitation reported by so many wineries and the corresponding lower sales through tasting rooms decreased our opportunity to capture new wine club members in the way that we’ve been most used to doing it. We count on providing visiting guests with an amazing experience, knowing that they will fall in love with our winery and become a member. Without that opportunity, sign-up rates can falter. Combine this with increased wine club cancellations from consumers wanting to be careful with their spending due to the uncertain economy, and we have a perfect storm for poor club results in a quarter which usually represents a substantial part of winery annual club sales.

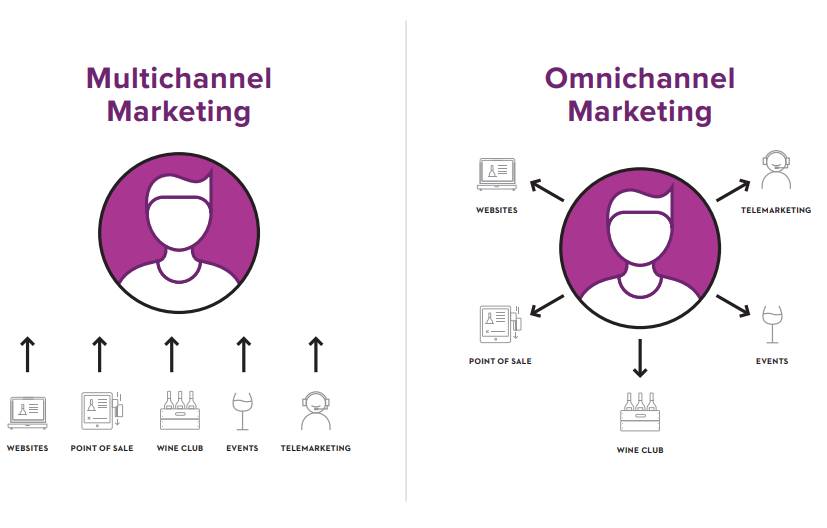

So, what can we do in the face of these trends? The single biggest learning we’ve had as an industry over the past five years is that we can’t rely on a single channel to drive long-term results and we must embrace omnichannel thinking. While most wineries have been operating in multiple channels, too often we’ve been treating our DTC channels as standalone, focusing on one at a time. In 2020, wineries worked hard to build website sales in the face of winery closures, but once wineries reopened, many of us fell back into our hospitality comfort zone and refocused efforts on on-site and our website sales suffered.

When we speak about omnichannel, we are talking about a consumer-focused approach where we deliver a consistent brand experience everywhere we sell to meet consumers where they are to build relationships that transcend channels. It requires reviewing and optimizing your business plan, focusing on channel diversification. This means reducing our reliance on on-site visitation to sell memberships and coming up with creative ways to use all our channels together to drive better overall results. Over the next weeks, we’ll provide more specific ideas, case studies and more information as to how we've designed our all-new platform to address this need within our industry.

For now, here are some suggestions to get you started: